Every value stream runs from raw materials all the way to the end customer. And value for the customer is only delivered at the very end.

In many service industries, of course, the “raw material” is information rather than molecules — like the data in the claim application processed by an insurance company. But the situation is the same. Value is only delivered at the end of the stream.

Today I see a lot of progress in applying lean thinking to isolated segments of the value stream, even across functions within firms. But optimizing the entire stream as it flows between firms — to truly solve the customer’s problem while helping all the providing organizations to prosper — still seems to be elusive.

Take the case of motor vehicles. As customers, we do want to obtain a physical object called a car or a truck. But the real problem we are usually trying to solve is personal mobility: We want to get places cost-effectively with no hassle or wasted time. So the processes of buying the vehicle and then keeping it running through an extended life are critical parts of the complete value stream. This total stream must link the car manufacturer’s design and production processes to the car dealer’s sales and service processes.

I’ve just been looking at the data collected by J.D. Power and Associates on customer satisfaction, by brand of vehicle, with the car buying experience and with the car service experience in the U.S. And I’ve been comparing this information with data on satisfaction with the vehicle itself. Not surprisingly, Toyota continues to capture top scores for satisfaction with the vehicle among brands sold in the U.S. Its Lexus brand was # 1 in 2006 while Toyota was #4 despite some recent problems with recalls. These data are for problems encountered with the vehicle in the first three months of ownership and the results are similar after three years. Lexus buyers report the fewest problems while the Toyota brand is in 5th place among the 37 brands in the market.

But the service experience at Toyota dealers — as tracked by the Power Customer Service Index — ranks 27th among thirty-seven brands. (Lexus is number one.) And the buying experience at Toyota dealers — as shown by the Power Sales Satisfaction Index — ranks 29th out of 37. (Lexus is number two.)

What’s worse, as Dan Jones and I report in our recent book, Lean Solutions, (where we provide data collected by the International Car Distribution Programme) all 37 brands are terrible at meeting customer needs cost effectively! Thus Toyota dealers are performing poorly in a race where no one is doing well.

In sum, Toyota solves half the customer’s problem by delivering high-quality vehicles. But it is still struggling to solve the whole problem by perfecting the entire value stream of the vehicle plus sales and service.

How can this be? And how can Toyota’s performance in its largest market — the U.S. — be so different from its performance in its home market in Japan where the Toyota buying and service experience is legendary for the customer satisfaction it provides?

The heart of the problem I think is that Toyota dealers in Japan are co-owned by Toyota. So applying process thinking to the selling and service processes is much easier: The dealer really must listen. In the rest of the world car dealers, for all brands including Toyota, are independent businesses. And, in my experience, most car dealers — certainly not just Toyota dealers — are “hunters.” They focus on making the sale at an advantageous price and moving on to the next sale. What’s needed instead are “farmers” who carefully study their selling and service processes to completely solve every customer’s problems through the life of the vehicle.

So the simple fact is that because Toyota dealers have had a superior product to sell they could afford to treat the customer poorly. The combination of a high quality vehicle plus inferior sales and service — which comprise the total customer experience — was still competitive in the marketplace. What’s more the dealers erroneously believe that creating a superior buying and use experience must cost them money.

Lexus dealers, by contrast, do treat their customers well. But they seem to achieve this by spending more on sales and service, not by creating smooth flowing, lower-cost value streams. With a higher-priced product, they can afford to do this despite the waste in their processes.

We now know that the belief that better sales and service costs more is simply wrong. In fact, better sales and service, like better quality in products, actually costs less. This is because large amounts of wasted time and effort for dealers and customers can be eliminated through careful process analysis. Dan Jones and his colleagues at the Lean Enterprise Academy in the U.K. have clearly demonstrated this through their work with the GFS car dealing system in Portugal where one of third of the cost of providing a given amount of service was removed even as the level of customer service was dramatically improved.

Now that other manufacturers are closing the gap with Toyota brands on delivered defects and product durability — look, for example, at the recent progress of Hyundai — Toyota is finally taking steps to perfect its value stream all the way to the customer. It has recently launched experiments at five European dealers with the “Toyota Retailing System” designed to apply the techniques of the Toyota Production System to sales and service. As experience is gained, Toyota hopes to expand this system to dealers all over the world.

I don’t doubt that Toyota will make progress with this initiative, although turning hunters into farmers is a major challenge. But what about the rest of us, whatever industry we are in? Almost all firms in today’s de-integrated world either reach their end customer through other firms or obtain the items they need to solve their customers’ problems from many suppliers. The end customers — that’s you and me in our role as consumers — are only interested in the value delivered at the very end of the value stream. And we certainly don’t want to hear about the difficulties that retailers, distributors, manufacturers, and supplier are having cooperating with each other to solve our problems.

So the challenge now for all of us — no matter which customers we serve — is to begin conversations across firms about optimizing total value streams. The best approach is to take a walk together, backwards from the end customer (or, even better, with the end customer), in order to draw an accurate map of the total value stream with all its shortcomings. Then it’s time to talk seriously about how to create a smoother-flowing, higher-quality, lower-cost value stream that can be a win-win-win for providers, their suppliers, and consumers, as everyone learns to think end to end.

Best regards,

Jim

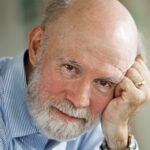

Jim Womack

Chairman and CEO

Lean Enterprise Institute (LEI)

P.S. In our recent book, Lean Solutions, Dan Jones and I provide visual tools for drawing both provision and consumption streams, showing the experience of the consumer on the one hand and all of the providing organizations on the other. Together with the methods described in our previous workbook, Seeing the Whole, these can create a complete end-to-end value-stream map which is a great guide to improvement efforts across firms. I hope you will find that the tools we have devised are useful in perfecting your own value streams from end to end.