As a full-time lean coach these last 10 years, many people have asked me questions like, “What is the ROI on a kaizen event?” or they have looked at Lean as an initiative to be compared against another initiative. For instance, comparing lean practice to a new market expansion initiative.

To me, these questions and perspectives reflect a very incomplete and superficial understanding of the application of lean principles to enhance enterprise performance. So for years I resisted the pressure to provide information on how to put financial value on a company’s lean efforts. I wanted to ensure that manufacturing executives understood, for example, that a typical presentation of financial profit results provides a misleading indicator of progress due to the generally accepted accounting principles (GAAP) related to inventory measurement. Lean-based results in manufacturing are hard to interpret from a value perspective using standard cost accounting. This is especially true when a company is used to building up inventory and suddenly, with application of lean principles, finds inventory plunging.

Accounting methodology is also poor at measuring things that do not happen, and Lean is based on eliminating waste, meaning it saves time and money by causing things not to happen. Using lean methods eliminates many activities (e.g. rework, expediting, scrap, excess production) and therefore, the traditional accounting data crunch is not helpful in measuring these types of value enhancing changes.

However, the questions about financial value continue to this day, and not just from people with only a cursory interest in Lean. I hear them all the time from people who think deeply about the issues and concerns of creating enterprise-wide engagement through lean thinking. So, I’ve grudgingly concluded that lean practitioners cannot get around “executive must have numbers”, and have started working to provide some insights that helped me evaluate my team’s lean efforts during my CFO tenure at Lantech in the 90s.

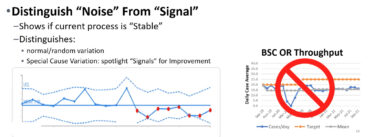

I talk with practitioners about seeing the value in monitoring both the quantitative and qualitative benefits of Lean. I try to help organizations develop their own methods to evaluate the financial impact of their lean improvement activities and waste reduction efforts. My goal is to show how use of accounting information can effectively present the value realized by lean activity throughout the company. Much of the challenge has to do with how to present accounting information in non-traditional ways so that non-accountants in the organization can understand it. This is important as you want to be able to share the positive impact lean changes are producing.

In the end, understanding the real value of lean practice is also about anticipating the benefits of future process changes and linking not just tools to organizational strategy, but impact to financial performance. Unfortunately there is no rigid rulebook about how to look at the performance of your business in a holistic way, but there are ways to fill the gap in the current thinking being offered on the subject for deep lean thinker. What questions do you have on lean and financial performance?